March 21, 1983 marked the beginning of a remarkable journey that would last a lifetime. This journey has been shared with my family, many dear friends, and countless audiences throughout the world. I have been blessed to observe the emotional impact created by the retelling of the stories from this journey.  Stories that make people laugh with joy, cry with compassion and think differently with love about life in general; all through the efforts to educate, share life’s learning experiences, and to grow society’s embrace of the truth through moral and ethical principles.

Stories that make people laugh with joy, cry with compassion and think differently with love about life in general; all through the efforts to educate, share life’s learning experiences, and to grow society’s embrace of the truth through moral and ethical principles.

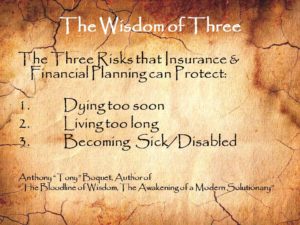

It was in the early steps of this journey that I was introduced to the three primary risks that must be protected against in the event someone wished to live out a financially sound life for them and their family. The mentor that walked with me in those formative years was emphatic that I be able to fully grasp the severity of each peril and be prepared to offer the right solution for each problem.

“The weight of the final decision will rest on the client. However, it is your honor-bound duty to be trustworthy, knowledgeable, and altruistic as you offer them the same solutions you would use personally were you in the same situation.”

“The weight of the final decision will rest on the client. However, it is your honor-bound duty to be trustworthy, knowledgeable, and altruistic as you offer them the same solutions you would use personally were you in the same situation.”

It is universally known that we must all end our life’s journey at some time in the future. As I like to tell my clients, “Dying is never the problem because we all will die. No, the problem is that we do not know when we will die. That is the problem!”

A very wise carpenter who lived over two thousand years ago once said, “Suppose one of you wants to build a tower. Won’t you first sit down and estimate the cost to see if you have enough money to complete it? For if you lay the foundation and are not able to finish it, everyone who sees it will ridicule you, saying. ‘This person began to build and wasn’t able to finish’.”

So it is with all that we do in life; we must finish what we start. It takes planning, the proper use of our resources, and the protection against the three known pitfalls. Each of these three risks can be negated by some type of insurance or investment vehicle. Insurance by definition is just a tool to transfer or spread the risk among many.

I realize that just like I do not know how to conduct a lung transplant surgery; most people do not know all the intricate workings of insurance and financial products or services. Thankfully there are Solutionaries in each field of expertise. Do not be intimidated by those things that you know little about; instead seek out a qualified and trusted Solutionary or Solutionaries who are familiar with those areas of expertise.

Take the first risk, dying too soon. Life Insurance is designed to protect against that very problem. If you want to have a million dollars by the time you and your spouse retires, want to pay off the mortgage in fifteen years, or have enough money to send the kids to college in 18 years; all doable as long as your income continues because you are alive and able to earn a living. The miracle tool called life insurance steps in to make your wishes a reality if you do not live long enough.

Living too long could mean having a reliable income that you cannot outlive once you stop or can’t work. This can be accomplished by soliciting the wisdom of a qualified Solutionary in financial and retirement planning who will be able to guide you through appropriate budgeting and investment strategies while at the same time securing adequate insurance protection, such as life, long-term care insurance, and medical insurance.

Finally, if we are responsible financial stewards, we will consider a solution if we happen to lose the ability to earn an income due to disability. How would the rest of our financial goals be satisfied if our income is drastically reduced? With the correct disability insurance plan in place, your life’s financial goals will not be disrupted.

If this is my last post, I want all to know that there was only one purpose for all that I have written; to have made a positive difference in the lives of others.

Anthony “Tony” Boquet, the author of “The Bloodline of Wisdom, The Awakening of a Modern Solutionary”

Thanks you Jona! I truly appreciate your kind words. Please follow me on Twitter too, MSolutionary and continue to share this information with your friends. Also, please continue to chime in with your comments. I enjoy hearing words of wisdom from others.