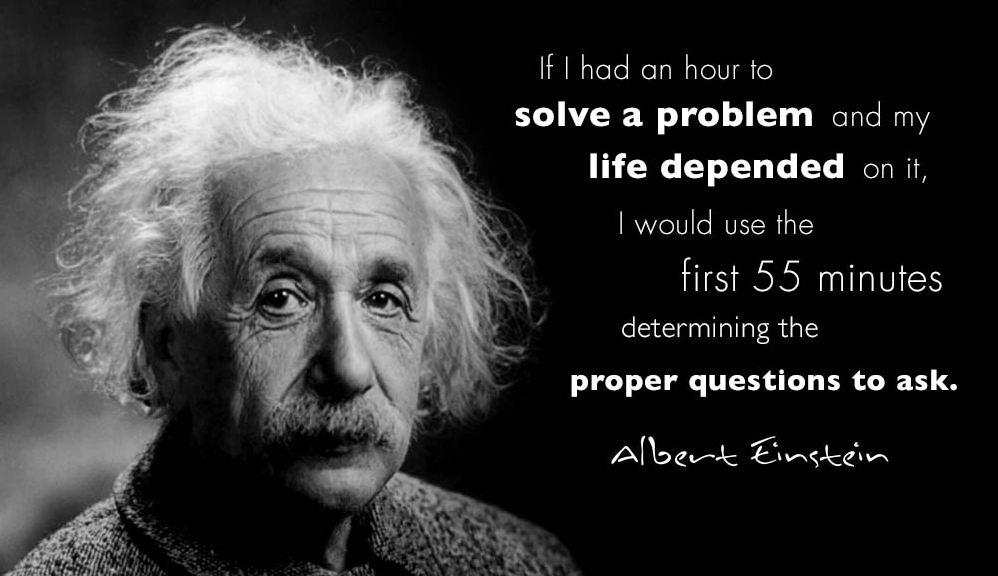

“When we ask the wrong questions, we normally receive the wrong answers. Even when we know nothing about our problem, it is our responsibility to ask the right questions especially when speaking to those we seek assistance from in solving them. A Solutionary is someone who understands this fact and they use their knowledge in a selfless manner to solve the problems brought to them.”

Anthony Boquet, A Modern Solutionary

Every species on earth depends on balance to function at optimum performance. This balance is more difficult to achieve in the human species because we are the only creature that has the ability to act against the natural laws. It is our freewill which allows us to make choices based on the whims of our three states of humanity; our physical, mental and spiritual selves. Our higher level of intelligence also makes it possible for us to reach that perfect balance while at the same time creating internal battles over the complexities of protecting our body, mind and soul in equal unity.

Take for instance our financial responsibilities through our retirement years. The average person does not have the education or experience to plan for this daunting task. Someone well trained as a financial planner would know how to solve the financial problems people face in all aspects of their lives. To do this job completely and correctly, one must be willing and able to guide their client along their life journey, being responsible for balancing their financial matters in every phase of life where money plays a part, namely our three personas; our personal, professional and spiritual lives.

A very large majority of planners have no problems when it comes to the professional persona because they are dealing with the client on a professional level by just doing business with them. An equal number of them can rise to the occasion when it comes to the personal persona, especially when their client / planner dynamic share personal commonalities…their kids play on the same ball team or they each have young children. It is the spiritual life that stumps most planners, mainly due to societies perception of the need to separate spirituality from our work life. In other words, people can see one another at Church on Sunday but on Monday we can no longer talk about our spirituality. A ridiculous mindset since each of us possess a spiritual persona requiring financial planning. It does not matter which religion one follows; it is the fact that we each have some form of spiritual belief that we support through our income and wealth.

Needless to say, finding that perfect balance in the financial area of one’s life could prove difficult not only because of the self-inflicted imbalance caused by emotional decision-making but also from that of the planner we choose to work with. An important correct question should be, “What can I do to protect myself against further financial imbalance?”

The answer is to learn, profess and live the truths of financial literacy. The first truth one should follow is the understanding that there are only three uses for our treasures. Once you earn any treasure you can chose to spend it, save it or share it; nothing more. Achieving balance in anything requires the appropriate distribution of the whole into the correct areas; thus balancing the unit. The optimum appropriation percentages for a healthy budget is usually; seventy percent of what we earn should be allocated for spending (paying our bills), twenty percent should be placed in savings (ten percent long term and ten percent short term saving) and ten percent should be shared. If your bills add up to more than seventy percent of your take home pay you are likely out of balance. For short periods of time going above the seventy percent might not be an issue but habitually exceeding that percentage will create problems. The same can be said about the other two components as well. Balance is critical and fighting the truth by defending your over spending, choosing not to save and failing to share from your abundance will never create financial balance.

Once you have the basics down the question becomes, “Do I need to hire a professional for assistance?” If you do, you should expect that person to live those same truths and selflessly apply their knowledge to your solutions. You are looking for a Solutionary. The next question is; “How do I determine their level competence?” First, select a planner who can demonstrate their commitment to being a Solutionary not just a problem-solver. Everyone we hire to assist us in solving our problems should be knowledgeable in the field of expertise the problem is in. This knowledge must come from three sources; education, experience and moral / ethical values. We should never apologize for asking for credentials verifying the level of each. When determining education, degrees or designations assures that the person learned and successfully tested their understanding of the field of study. Experience is gauged by the amount of time worked in the profession. Moral and ethical values can be more of a challenge in today’s world. If the person holds a credential, usually the issuing body oversees the ethical standing of their members. Asking questions about their beliefs and values can also shed light to their character. With the internet, we can also easily research the background of anyone, including their social activities through various sites.

Anthony “Tony” Boquet, Vice President, The American College and the author of “The Bloodline of Wisdom, The Awakening of a Modern Solutionary”

If this is my last post, I want all to know there was only one purpose for all that I have written; to have made a positive difference in the lives of others.